Mergers and Acquisitions Advisory

Strategic Expertise for Middle-Market Business Sales

Mergers and acquisitions are the next level of business transfer for companies that have grown beyond the traditional brokerage market. These transactions often involve complex deal structures, institutional buyers, detailed financial analysis, and strategic goals that reach far beyond a simple ownership change. For companies with enterprise values typically ranging from 5 million to 10 million dollars and higher, a structured and disciplined M&A process is essential. My role is to guide owners through that process with clarity, confidentiality, and a steady focus on long-term value.

Why M&A Advisory Matters for Middle Market Businesses

Mergers and acquisitions are the next level of business transfer for companies that have grown beyond the traditional brokerage market. These transactions often involve complex deal structures, institutional buyers, detailed financial analysis, and strategic goals that reach far beyond a simple ownership change.

For companies with enterprise values typically ranging from 5 million to 10 million dollars and higher, a structured and disciplined M&A process is essential. My role is to guide owners through that process with clarity, confidentiality, and a steady focus on long-term value.

The summary below outlines how M&A differs from business brokerage, who the buyers are, and what a structured process supports.

How M&A Differs from Business Brokerage

Business brokerage works well for smaller, owner-operated companies. M&A advisory is designed for firms with professional management teams, strong financial records, and established market positions. These companies draw interest from strategic and financial buyers who evaluate opportunities based on future growth, scalability, and the strength of the management structure in place.

Key differences between the two include:

Where business brokerage focuses on facilitating a confidential sale, M&A advisory adds a deeper layer of financial insight, competitive analysis, and long-term planning. This work must be done with precision and strict confidentiality to protect the value of the company throughout the process.

Who the Buyers Are in Middle Market M&A Transactions

M&A buyers are typically sophisticated, well-capitalized groups with defined investment strategies. They evaluate companies not only on past performance, but also on future potential and how well the business fits their broader growth goals. Understanding who these buyers are helps position each company for the right type of transaction.

Acquire platform companies or add-on businesses that expand existing holdings.

Invest private wealth into established companies with long-term, stable returns.

Competitors or industry partners seeking market share, capabilities, or geographic expansion.

Search Funds and High-Net-Worth Operators

Entrepreneurs or investors seeking a well-managed business to acquire and grow.

These buyers bring both capital and strategy, making it possible for sellers to achieve outcomes that reflect not only the value of the business today but its potential over time.

How Sophisticated Buyers Think

M&A buyers evaluate companies not only on past performance, but also on future potential and how well the business fits their investment strategy.

A disciplined process supports confidentiality, structured execution, and the clarity needed to protect value through diligence and closing.

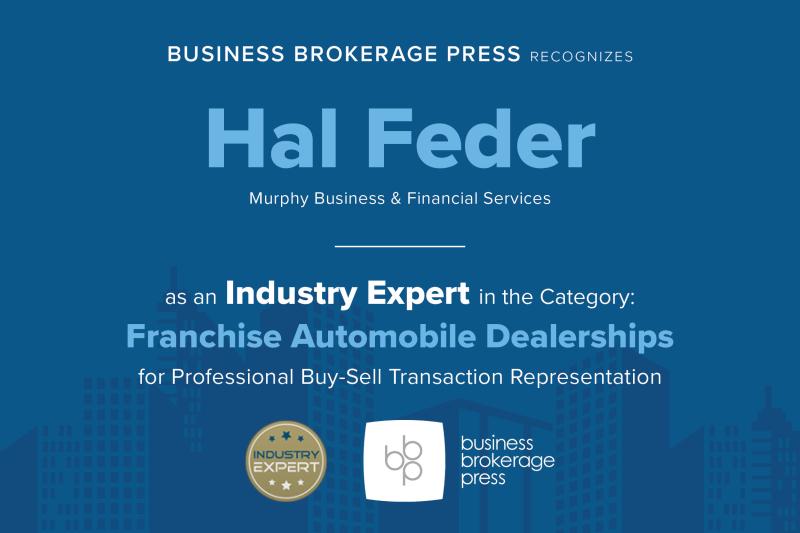

A Boutique M&A Advisory Approach with National Reach

As a Certified M&A Advisor and Business Intermediary, I offer the hands-on guidance of a boutique advisory practice while drawing on the national resources of Murphy Business and Financial Corporation. Murphy is one of the largest and most respected business brokerage and M&A organizations in North America, supporting complex transactions across a broad range of industries.

Murphy’s national platform provides:

- Access to thousands of pre-qualified buyers and institutional investors

- Proprietary databases and market research tools

- Experienced valuation, lending, and due diligence support

- A decades-long record of successful middle-market closings

This combination of personal attention and national reach allows each transaction to move forward efficiently, with clear communication and a structured strategy from valuation through closing.

Comprehensive M&A Services

My advisory process supports owners through every stage of the transaction. This approach helps maintain momentum, manage confidentiality, and reduce the stress that often accompanies major business transitions.

Services include:

Strategic valuation and market positioning

Strategic business valuation and market positioning.

Buyer identification and negotiation

Targeted buyer identification and qualification, plus deal structure and negotiation management.

Diligence and closing oversight

Coordination with attorneys, CPAs, and lenders, with oversight of due diligence and closing.

Each step is tailored to the company’s goals, industry, and potential buyer profile.

Industries Served

Middle-market transactions require deep familiarity with industry trends, buyer expectations, and operational structures. Drawing on decades of leadership and transactional experience, I represent clients across a wide range of sectors.

Automotive and Transportation Services

New Car Dealers • Boat Dealers • PowerSports Dealers • RV Dealers • Marinas • Car Washes • Gas Stations

These businesses serve mobility, recreation, and transportation needs. Transactions may involve real estate, specialized equipment, manufacturer requirements, and brand-related considerations. Buyers in this sector often focus on scalable operations, recurring service revenue, and geographic reach.

Construction, Contracting, and Building Supply

Roofing Contractors • Electricians • Plumbers • HVAC Service & Installation • HVAC Parts & Supply • Home Improvement Contractors • Building Supply

These firms support commercial and residential construction markets. Buyers value steady demand, skilled labor, established customer relationships, and strong asset bases. Many acquirers seek operational efficiencies or regional consolidation opportunities.

Manufacturing and Industrial Services

Industrial Machining • Ball and Roller Manufacturing • Machine Tool Manufacturing • General Purpose Manufacturing • Powder Coating Companies • Modular Buildings

Manufacturing companies often draw interest from strategic consolidators and private equity firms seeking scalable platforms. Buyers focus on equipment value, production capability, management depth, and long-term customer relationships.

Property, Storage, and Facility-Based Services

Warehousing & Storage Companies • Self Storage Businesses • Mobile Home Parks

These sectors attract investors due to predictable revenue, strong asset values, and long-term stability. Buyers often include real estate investors, family offices, and private equity firms seeking reliable, asset-backed returns.

Home, Health, and Community Services

Landscaping • Home Health Care • Pest Control • Garage Door Installation

These service-driven businesses rely on recurring revenue, route density, and community presence. Buyers look for established customer bases, efficient operations, and opportunities for regional growth.

Experience • Focus • Results

A successful M&A transaction requires strategic thinking, disciplined planning, and a commitment to confidentiality. Every deal I manage receives personal attention and a structured process designed to protect the business and maximize value. Supported by Murphy’s national reach and my local experience, I help owners achieve outcomes aligned with their goals for liquidity, succession, or long-term transition.

A Trusted Path for Your M&A Transition

Owners deserve a process that respects the business they have built and delivers a transition that reflects its true value. With disciplined preparation and the combined strength of local expertise and national reach, I help sellers move through the M&A process with clarity and confidence. Every transaction is managed with the goal of protecting value, minimizing disruption, and achieving the best possible outcome.

Ready to discuss an M&A strategy?

Click “Request an M&A Consultation” to start. If you have questions, call and we can walk through next steps.

Every transaction is managed with the goal of protecting value, minimizing disruption, and achieving the best possible outcome.