Home > Automotive

Business owners and dealers in Virginia looking to navigate mergers and acquisitions can get expert help. Hal Feder offers trusted M&A consulting services. He provides valuable insights and support every step of the way.

If you’re planning to sell your dealership, the first step to getting top dollar is understanding what’s really happening in the market.

The automotive dealership landscape has changed dramatically over the past few years. Shifting customer demand, tighter economic conditions, and ongoing consolidation all play a role in how buyers evaluate stores, set prices, and decide which deals to pursue.

Here’s what’s shaping dealership valuations right now and how you can position your store to sell for more.

Interactive Guide: Click or tap each icon on the timeline to explore the key steps in preparing your dealership for sale. From financial cleanup to building a ready-to-run management team.

Reporting consistency, accuracy, and identifying/planning for allowable “add backs” during the cash low re-casting process.

Liquidity health and managing frozen capital in inventory and receivables. Assessing the value of equipment and other assets that will be central in the transfer. An independent parts inventory and equipment appraisal before the sale can remove a lot of negotiation hassle and save time when you go to market.

Maintaining and building a successful, results-oriented team will add value at the closing table. Invest in training and succession planning.

Reviewing corporate structure, policy guidelines, regulatory, and legal issues for compliance and good order.

Setting up for the management of tax liability associated with the sale. It is wise to consult with deal structuring professionals and have a point of view for the allocation of the purchase price prior to listing the business.

Ensure proper maintenance, condition and appearance issues, and environmental compliance are in order. An independent real estate appraisal before the sale can remove a lot of negotiation hassle and save time when you go to market.

Managing the speed and nature of the exit, degree of seller involvement in the new ownership transition, and seller financing (if applicable). Any sale will also require the signing of a Non-Compete Agreement.

Assembling the right professionals to achieve your exit goals (legal, tax, wealth, business broker).

Moving from the fast-paced world of business ownership is not an easy task. Before deciding to sell, have a plan for how you will spend your time post-ownership

In most dealership sales, value is determined by reviewing both tangible and intangible assets that contribute to overall performance and profitability. The key valuation elements include goodwill or blue sky, parts inventory, furniture and equipment, real estate, and both new and used vehicle assets.

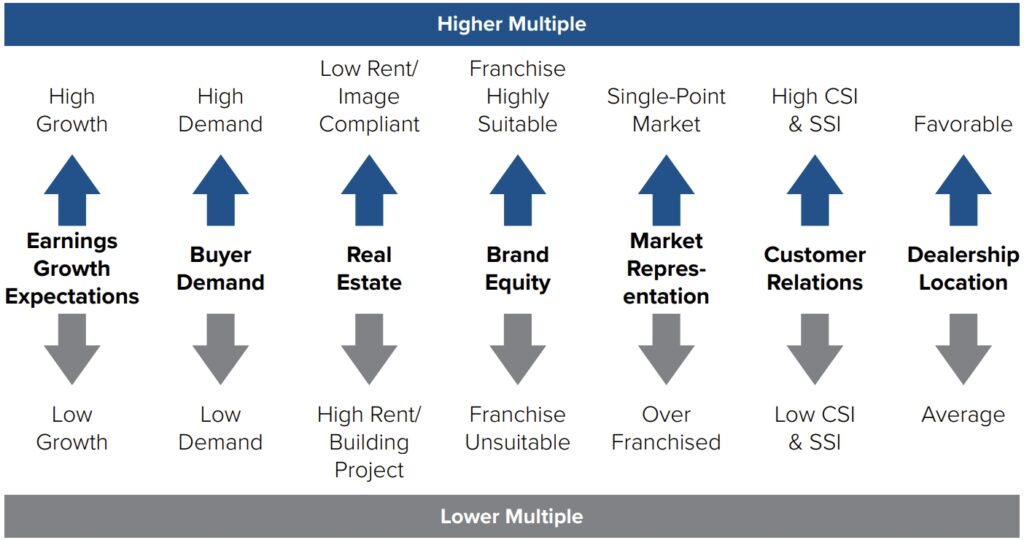

The value of blue sky is one of the most highly negotiated components of the sale due to the multitude of influencing factors and its subjective nature. Based on both external and internal factors, a multiple of the weighted average adjusted cash flow comprises the blue sky calculation. Adjusted cash flow is the net operating income of the business after “adding back” lender-recognized items such as depreciation, interest expense (non-floor plan), and discretionary or one-time items. The weighting references a cash flow look over a period of time (say 3 years) with more weight being placed on more current performance.

• Under Performance

• Metro vs. Rural Markets

• Low Tax/Real Estate Geography

The appraised or market value of the current OEM parts catalog inventory. Some buyers will specific those part numbers which have sold in the last 12 months. An independent appraisal will determine this value.

The market value of the FFE which is generally about 50% of the original acquisition cost. An independent appraisal will determine this value.

In general , the OEM’s goal is to appoint dealers who can improve sales, maintain profitable dealership operations, achieve high levels of customer satisfaction, and provide the necessary cash and capital structure to properly capitalize and operate the business. The key approval criteria are as follows:

Extensive retail franchise automotive knowledge and experience (Dealer and/or General Manager) is necessary in order to be considered as a Dealer candidate, coupled with a proven track record of satisfactory sales performance and successful dealership operation. Approvable candidates are many expected many times to provide management reports that reveal excellent sales effectiveness, customer satisfaction performance, and effective working capital history.

Candidates should have an established history of profitability, demonstrate the financial capacity needed to acquire the franchise(s), and meet or exceed our working capital requirements as determined by their Sales & Profit Forecast for the proposed operations. Sufficient unencumbered capital is critical to the success of a dealership, particularly given the cash required for necessary vehicle inventory, parts inventory, and accounts receivables. There is a direct relationship between these capital requirements and the volume potential of a dealership. Many times the Total Dealership Investment (including any paid for Goodwill) must be made on the basis of fifty percent (50%) or more unencumbered (not borrowed) funds and up to fifty percent (50%) borrowed funds. This standard is generally rigid and must be adhered to in all cases

One of the ways to ensure the OEM improves and maintains industry leadership is to make every effort to appoint new Dealers that have demonstrated the ability to fulfill and sustain mutual goals. Therefore, even with prior exceptional experience and performance that meets the criteria above, many OEMs will initially grant a limited Term Agreement (2,3, or 5 years) to ensure the new dealer delivers on the performance metrics before issuing a longer-term Continuing Agreement.

Work with experts who understand the automotive market and know how to position your business for success.